Surety Bond Probate

A certain kind of court bond known as a probate bond is granted on the performance of an executor of the estate of a person who passed away in the recent past. It basically serves as an assurance that the executor of an estate will carry out their duties in accordance with the laws of the state as well as the provisions of the dead person’s will or trust.

In the event that the executor fails to comply with state laws or acts in a manner that breaches the conditions of the will or trust, the heirs of the dead person as well as any other stakeholders may make a claim against the bond. In the event that the claim is found to be legitimate, the surety who sold the probate court bond to the executor is obligated, in accordance with the provisions of the bond, to compensate the person that submitted the claim.

It is the obligation of the executor or administrator to acquire one, just as it is the responsibility of that person to purchase other types of surety bonds.

The Probate Process Identified

To begin, it is essential to have a solid understanding of how the probate procedure works. The individual who writes the will, known as the testator in legal parlance, is able to give instructions on the distribution of their belongings and the care of any dependent family members when they die. These instructions may be found in the will.

The directions included in a will must be carried out through the probate court system, and it is also responsible for mediating any conflicts that may emerge.

The following are the typical stages that are taken throughout the procedure that is followed in probate court:

- It is necessary to locate the will of the testator, get it validated, and then submit it to the court for probate.

- Either the directions in the testator’s will or the court must be followed in order to designate an executor or personal representative. Both of these roles are legally required.

- The testator’s property has to be found, inventoried, and valued before the will can be finalized.

- The testator’s assets are required to be used to pay off any obligations that the testator may have incurred during their lifetime.

- Both the federal government and the state governments require payment of estate taxes and property taxes on the testator’s property.

- The beneficiaries named in the will are the ones who are entitled to receive the testator’s assets.

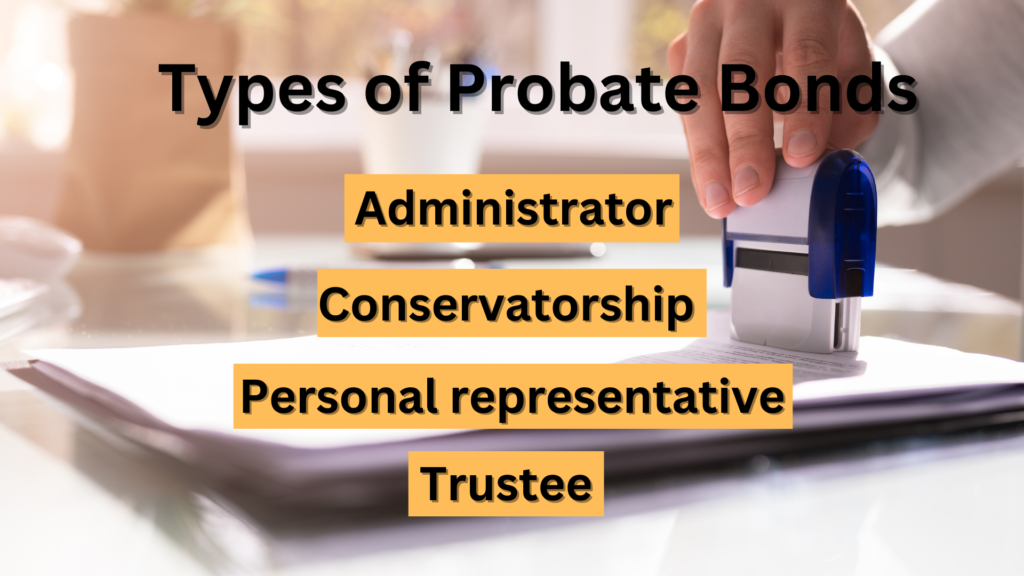

Types of Probate Bonds

In spite of the fact that they all serve basically the same purpose, probate court bonds may take a few different forms. Examples of types are:

- Administrator – bought by an administrator, who is usually appointed to an estate in the event that there is no will present. These bonds guarantee that the administrator will manage the estate in an honest and responsible manner.

- Conservatorship – guarantees that a representative who has been chosen by the court will execute all of their commitments to the heirs of a dead individual.

- Personal representative – someone who is designated in the will of a dead person to act as the representative of an estate. In their role as administrator, they are accountable for managing the estate in accordance with the terms of the will.

- Trustee – acquired by a trustee or another individual who is in charge of administering the estate of a dead person. It assures that the trustee will manage all of these assets in accordance with the directives outlined in the last will and testament of the dead person.

Parties in a Probate Bond

They are a contract between three parties, similar to other forms of surety. The first of the parties involved is the principal, also known as the person who is accountable for making a purchase. This individual is either the executor or the administrator of the estate of the person who has passed away.

The other party is referred to as the obligee. When it comes to a probate surety bond, the obligee is the person who will inherit the estate. While this term often refers to a member of the dead person’s family, it may be used to describe anybody who has a legal claim to an estate.

The third party acts as a surety for the contract. The principal purchases the bond from the surety, who is also responsible for compensating the obligee in the event that a claim is made on the bond.