Surety Bond Obligee

The surety bond obligee, the principal, and the surety carrier are the parties involved in a contract known as a surety bond.

The surety bond obligee is the party that is making the principal post the surety bond as a requirement. They demand the surety bond as a means of shifting the risk associated with the principal’s performance away from themselves and onto the surety carrier. If the principal follows through with what they have committed to doing, the bond is rendered null and invalid. Yet, the obligee enjoys the financial protection of the bond in the event that the principal does not.

Surety bond obligees are almost always affiliated with the municipal, state, or federal levels of government. It’s also possible for them to be people or companies who want the principal to carry out some task for them.

When the obligee is a government entity, the surety bond often serves as an assurance that the principal will comply with the rules and regulations that were set by the obligee. Whether it comes to a person or a company that is the obligee, the surety bond will often ensure the performance of the principal in accordance with a certain contract. This might refer to someone employing a contractor to construct a structure for them, or it could refer to a company recruiting a new franchisee.

In any event, the obligee has certain predetermined standards for the principal’s performance that they want the principal to adhere to, and the surety bond serves as a financial assurance that they will.

Surety bonds are an excellent instrument for the obligee to use in order to safeguard their people or themselves from the non-performance of the principal. The surety bond ensures that the principal will fulfill their obligation.

In the event of a company that operates on a franchise model, the bond serves as an assurance that the franchisee will carry out their responsibilities in accordance with the terms of their franchise agreement. In the event that they do not, the bond protects the company financially from the franchisee’s non-compliance with the requirements of the business.

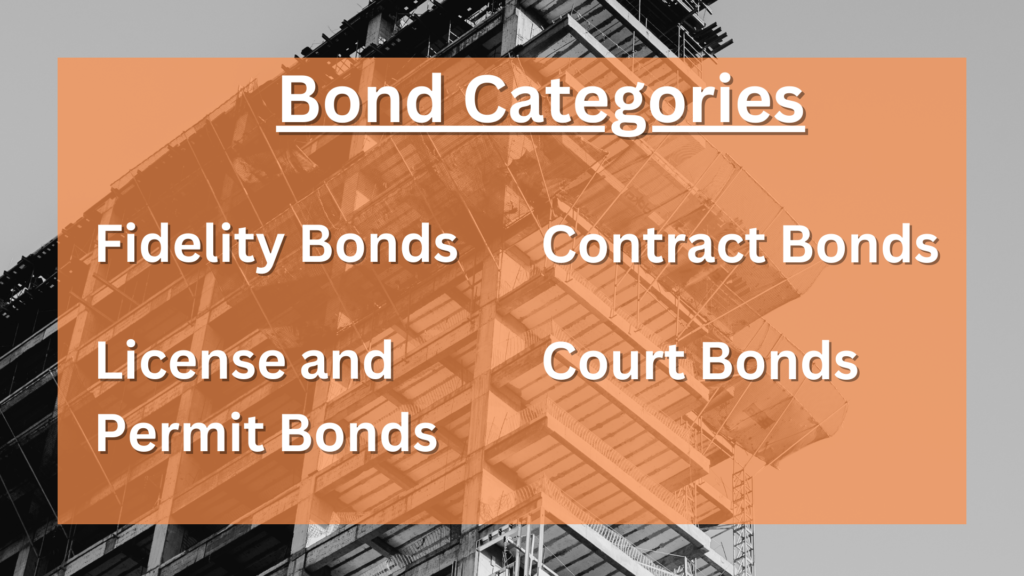

Bond Categories

- Fidelity Bonds – In the event that an employee causes harm to the employer’s money or property as a result of carelessness or dishonesty on their part, fidelity bonds protect the employer from financial loss.

- License and Permit Bonds – There are a variety of licensing processes that need the submission of a surety bond in the form of a license and permit bond. They have the ability to compensate a governmental body for the principal’s failure to comply with an applicable law, or they can give a third party the right to pursue the principal for any loss or damage that the third party incurred as a result of the principal’s default. Both of these options are available.

- Contract Bonds – If you wish to undertake work on public projects and even certain private ones, you will be asked to post contract bonds to guarantee that the tasks will be finished in a satisfactory manner. These could be needed by the owner of the property, or it might be the general contractor who engaged you as a subcontractor.

- Court Bonds – You are obliged to post court bonds to guarantee that you will complete your commitments in accordance with the law or the court’s orders.