How to qualify for a surety bond

Many have trouble meeting the requirements to get the surety bond they need from time to time. Sometimes individuals have even been bonded in the past – some for years – but now they are having trouble qualifying for a bond renewal because their circumstances have changed.

People are often unaware of the fact that there are a number of factors that may contribute to their ineligibility for a bond, some of which may not even be their own fault.

One possible explanation is that numerous government entities have recently instituted additional bonding requirements. The most recent economic slump has, in general terms, resulted in a significant tightening of qualification criteria.

Regrettably, there is no way to get around this obstacle. You may, however, increase the possibility that you will be able to qualify for the bond that you need by taking certain steps.

It is possible that you will not be able to qualify for the renewal of your surety bond or for initial approval if you have a poor credit score or if your score has decreased from the time that you acquired your first surety bond. A modest improvement of only a few points on your credit score might provide you with an additional boost toward acceptance.

The destruction of company property is another issue that might delay the acceptance of your request. If, for instance, your cash deposits have decreased in the time since you got your first bond, you run the risk of not being authorized for the new bond. The fact that you have been the subject of bond claims in the past as a surety bond holder might also prevent you from obtaining a bond.

You will be relieved to know that there are just a few stages standing between you and qualifying.

However, even though you may have been dealing with the bond salesperson down the street for the last several years, it is important to keep in mind that he just does not have the connections to many insurance providers that national bond businesses have.

On the contrary, partnering with a major brokerage firm expands the scope of your search and increases the likelihood that you will be authorized for a loan at a more favorable rate. Large surety firms will not have any issues working with you even if you have a credit score that is not as high as you would want it to be. You merely have to collaborate with a broker who is authorized to provide surety bonds to those with poor credit.

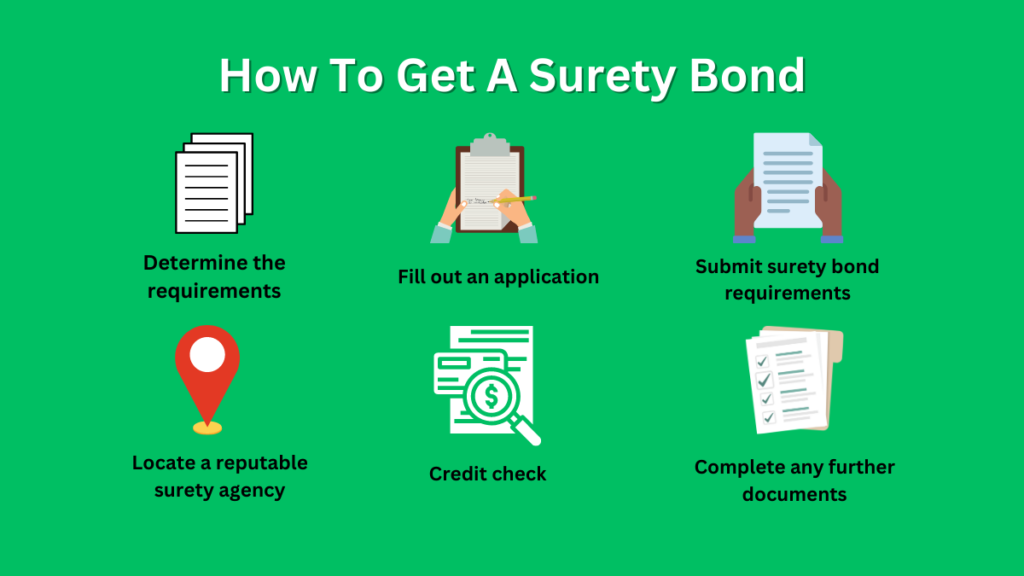

How to get a surety bond

There are hundreds of distinct types of surety bonds, and each one has its own set of laws and restrictions that are determined by the state in which the person applying for the bond resides or works. The criteria for surety bonds can differ from case to case.

- Determine the requirements for the surety bond.

- Locate a reputable surety agency.

- You need to fill out an application for a bond.

- Let a credit check be performed.

- Submit surety bond requirements.

- Complete any further documents that may be necessary.

The importance of your credit score

Alterations to one’s credit score or having a poor score are not necessary deal breakers when it comes to obtaining a surety bond. Many businesses are aware that credit ratings may shift over the course of time and that life may sometimes provide unexpected challenges. You will need to look for a company that is willing to deal with your particular credit circumstance and past bonding experience.

In addition to that, the qualifying conditions for you, the bond principal, may change if you need many bonds for all of the services that you provide because of the breadth of your business. The state in which you reside might also have an effect on the kind of bond you are required to have as well as the cost of the bond.