What Is a License and Permit Bond

A license or permit bond acts as a financial assurance that a company will comply with the rules and regulations set out by the relevant government agency. Consumers and governments are protected against financial damages that might be incurred as a result of illegal company actions – thanks to the bond. Anyone who has been affected as a result of unlawful conduct taken by a company has the ability to file a claim against the bond in order to obtain compensation.

When it comes to carrying out activities, like building or maintaining roads, several companies are required by law to get the appropriate license or permission from the relevant government body. A company may be required to acquire a license or permit bond before it is allowed to submit an application for a license or permit.

A License or Permit Bond is a sort of a surety bond. A surety bond is simply a promise given to a client that the job will be finished. It gives monetary reparation to a consumer or government agency for damage caused by a firm that has broken a law or regulation, and it does so in the event that the consumer or government agency was the victim of the violation. Before submitting an application for a license, a company could be required to purchase a licensing bond beforehand. The surety bond gives the general public the confidence that the company in question is reputable and trustworthy.

Before any work may be done on land that is held by the municipality, the municipality may demand that a License and Permit Bond be submitted beforehand. If the company causes injury to a third party by committing fraud or breaking the law in any other way, the surety (the bond issuer) will pay compensation to the person who was harmed.

A licensing bond for contractors is an example of this kind of license bond. Before being able to submit an application for a contractor license, construction and trade contractors in several states are first required to acquire a contractor license bond. The bond provides reassurance to the consumers of the contractor that they will be reimbursed in the event that the contractor commits a breach of contract or delivers substandard work.

How It Works

A License and Permit Bond is a sort of financial assurance that includes three parties – the obligee, the principal, and the surety. It is the responsibility of the surety, when it offers a bond, to ensure that the principal will fulfill its commitments to the obligee. In the event that the principal fails to fulfill its obligation, the bond stipulates that the surety is obligated to pay the obligee the whole monetary sum.

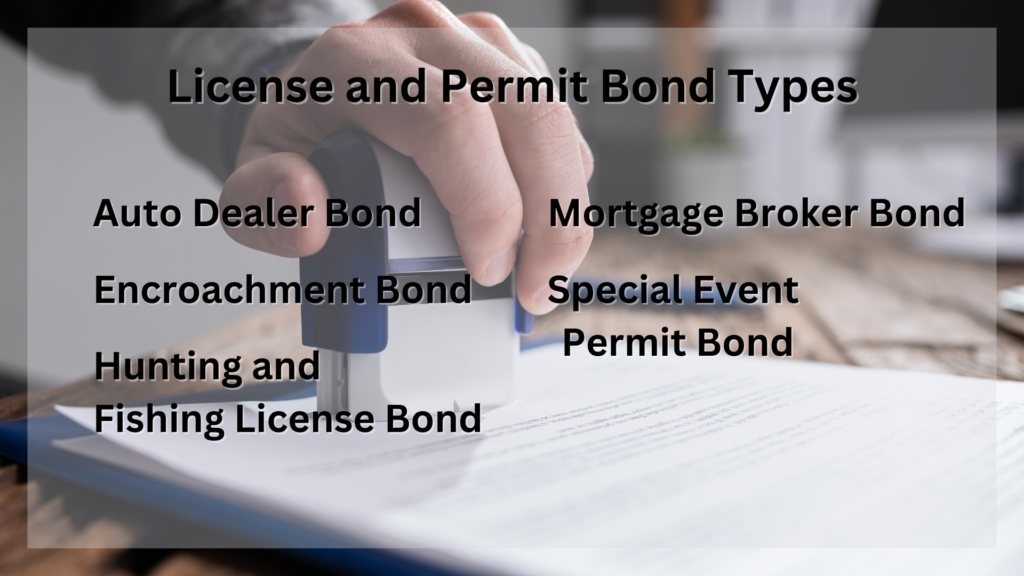

License and Permit Bond Types

- Auto Dealer Bond – Businesses that offer automobiles to the general public are required to have this certification in the majority of states. The buyer of a vehicle is guaranteed the ability to acquire a clear title – thanks to the pledge.

- Encroachment Bond – An encroachment collateral may be required to obtain a permission from a municipality or county. A contractor might need an encroachment authorization if they are working on private property that could potentially trespass on public territory. The surety ensures that financing will be available to replace or recover any government property that is damaged or altered as a result of the contractor’s actions.

- Hunting and Fishing License Bond – In some regions, businesses that offer hunting and fishing licenses or that provide escorts for hunting and fishing expeditions are required to obtain a license in order to legally operate in those regions.

- Mortgage Broker Bond – Before being granted a license, mortgage dealers must satisfy the requirements of certain states by acquiring a security bond first. It is guaranteed by the security assurance that the dealer will comply with the requirements of the state when dealing with consumers.

- Special Event Permit Bond – A significant number of state as well as local governments require organizations to deposit a surety prior to submitting an application for authorization to coordinate a special event, such as a procession or marathon.