License and permit bond

A license and permit bond is a specialized kind of surety bond that is sometimes referred to as either a license bond or a permit bond. Regardless of the terminology, obtaining one of these bonds is needed by government agencies as a prerequisite for doing business in a variety of sectors.

When a service to the general public is being offered by a supposedly qualified contractor or business person, the license bond will be required as a means of protection for consumers who are availing themselves of the service. This is the general rule of thumb regarding which businesses require a license and permit bond.

This indicates that the security given by these bonds is not intended to protect the person who bought the bond or the person who runs the firm, but rather it is intended to safeguard customers who do business with the contractor in question.

The licensing bond has the purpose of ensuring that any business owner operating in one of the needed sectors of commerce will run their company in accordance with all local, state, and federal rules that are applicable to the industry.

Since there will be a particular set of restrictions that apply to the sector in question, and because those regulations will be included in the wording of the bond, each bond can only be used in a single industry.

In actuality, these bonds protect customers against fraud, ineptitude, bad craftsmanship, and non-compliance with several other rules imposed by the government. In order to lawfully begin operations, a company will be required to purchase one of these bonds in order to provide assurance to customers that they would conduct themselves in a professional manner.

Any company that is mandated to have one of these bonds but does not buy it before beginning operations runs the risk of having financial fines imposed on them, being arrested for breaking the law, or worse – potentially even serving time in jail for breaking the law.

The cost of license and permit bonds

A great number of license and permit surety bonds may be granted immediately without the need for underwriting for a small fee, which is normally just 1% of the entire bond amount.

While the majority of license and permit bonds may be issued immediately, there are a few that need to be evaluated by an underwriter before the cost can be calculated.

The major condition for being authorized for these bonds is the financial history of the individual acquiring the bond. This means that the amount that an applicant pays will be decided by their credit rating instead of their income. Individuals who have a solid credit history have a greater chance of having their bond application accepted, as well as a reduced monthly payment.

If you have poor credit, it is still possible to acquire underwritten bonds, but doing so will be more expensive than in the case of someone with high credit.

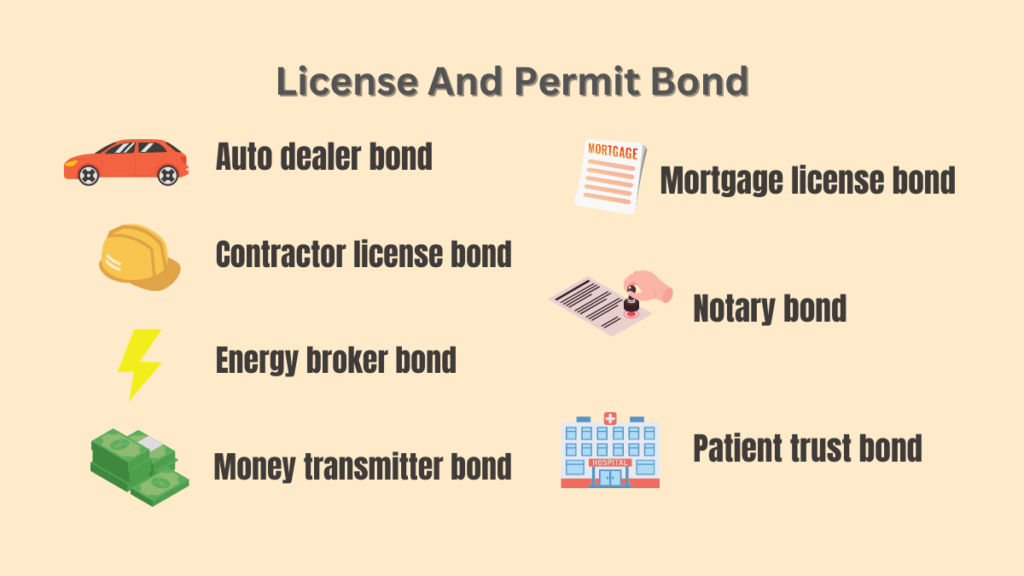

Categories of license and permit bonds

Since each kind may only cover a certain sector of the economy, investors have the option of purchasing a wide variety of distinct forms of these bonds. The kinds of bonds that are needed by law are given below:

Auto dealer bond

Customers are safeguarded from unethical behavior on the part of car dealers or any of the personnel working at a dealership by virtue of the existence of this kind of bond.

Contractor license bond

Before being granted a legal permission to operate in the construction industry, professionals in most states are required to acquire a contractor license bond.

Energy broker bond

Those that use competitive prices to attract customers to switch energy suppliers are required to have an energy broker bond in order to legally do business.

Money transmitter bond

Bonds for money transmitters are a way to ensure that a company will abide by the many rules and legislation that govern their profession.

Mortgage license bond

Before being granted a legal license to practice their profession in some jurisdictions, mortgage professionals in many fields are required to pay for and get a mortgage licensing bond.

Notary bond

A notary bond is a contract that is legally enforceable and promises that the notary will execute duties in an ethical manner and in accordance with the law.

Patient trust bond

Nursing homes and other types of assisted living facilities are required to obtain a patient trust bond in order to ensure that the trust funds of their patients are handled in a proper manner.