Surety Bond Rates

The cost of a surety bond is from 1% to 10% of the total bond amount. However, this might vary depending on the kind of bond that is needed of you and your current financial standing.

In most cases, the price of a surety bond is computed as a tiny percentage of the overall bond amount that is needed to be in place. This is how the cost of the bond is determined. Nevertheless, contractor bonds that are particular to public projects must be based on the whole value of the contract.

Your rate is a percentage of the total amount of the bond that you are required to pay, and it is a direct indication of how risky the surety firms perceive you to be.

Your chance of creating claims by failing to follow through with what your bond promises will determine the rate that will be applied to your payments. Remember that the surety business will pay any bond claims that are caused by your actions before they pay you.

On the other hand, when a surety firm creates a bond for you, they are essentially vouching for you by promising that if you cause bond claims, you would pay them back in full, which can be as large as the full bond amount.

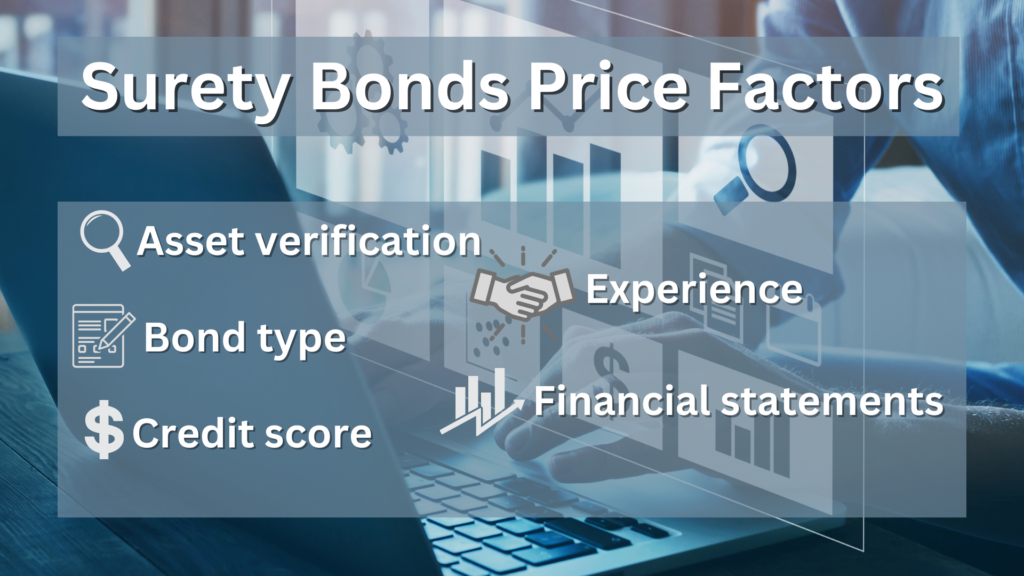

The Price of Surety Bonds is Determined by Many Factors

The proportion of the overall bond amount that you are responsible for paying is determined by a number of criteria, some of which include your credit score, the kind of bond that you need, your financial statements, the verification of your assets, and your level of expertise in the field.

- Asset verification

It is beneficial in estimating the risk you offer as a bondholder if you can verify the assets that either you or the company possess. If you can’t verify your assets and don’t have any, you can expect to pay a higher premium for your surety bond than those who can prove they have assets in their possession. - Bond type

The cost of the bond will be determined by the kind of surety you need. There are likely to be greater bond requirements for some of the other types of bonds that the federal government requires. Since the cost of the bond is based on the total bond amount, the premium that you pay will increase in proportion to the bond’s face value. - Credit score

A surety agency will consider you to have a standard risk level if you have decent credit, which is defined as having few or no bad marks on your credit record and a credit score that is reasonably high. When the cost of your bond is calculated using a lower interest rate, the percentage that you are required to pay is also reduced. If you have poor credit, the proportion of the total bond amount that you are responsible for paying will be much greater due to the increased risk. - Experience

Surety companies are seen as posing a considerably lower risk to those individuals who have been working in the same business for a number of years and have either very few or no bond claims than those individuals who are just beginning in the field. - Financial statements

When you apply for a bond in certain industries, your financial accounts may also be reviewed in addition to the application itself. If your financial statements are not sufficient or you are unable to submit them, you will be considered a higher risk and will be required to pay a greater proportion of the total bond amount as a result.