Surety bond broker

You will receive your surety bond via the services of a licensed representative of a surety bond firm, who is known as a surety bond broker. The majority of surety bond businesses do not collaborate directly with the principals of the surety bonds they issue.

Surety bond brokers that are well-established and are of high quality will provide clients with access to a wide variety of surety bond options and will collaborate with a number of different surety firms in order to reduce the cost of the surety bond to a minimum. They should also possess the appropriate license to sell surety bonds in the state, since this is a requirement of the surety bond.

Selecting a surety broker

When you engage into a connection with a surety bond company, you are basically entering into two significant relationships: one with your broker, and one with your surety.

Both of these relationships are quite crucial. Nonetheless, these two relationships couldn’t be more different from one another.

The role of the broker is to provide you with information, assistance, advocacy, and guidance throughout the assurance process, with the end aim of locating the surety that is best suited to satisfy your requirements. The surety is the entity that is responsible for really taking the risk and writing your bonds.

Depending on the circumstances, the surety may or may not have a close personal contact with you. If, on the other hand, surety bonds are a vital component of your company’s operations, it is strongly suggested that you ask your broker for assistance in cultivating a solid personal connection with your guarantor.

What to look for in a surety broker

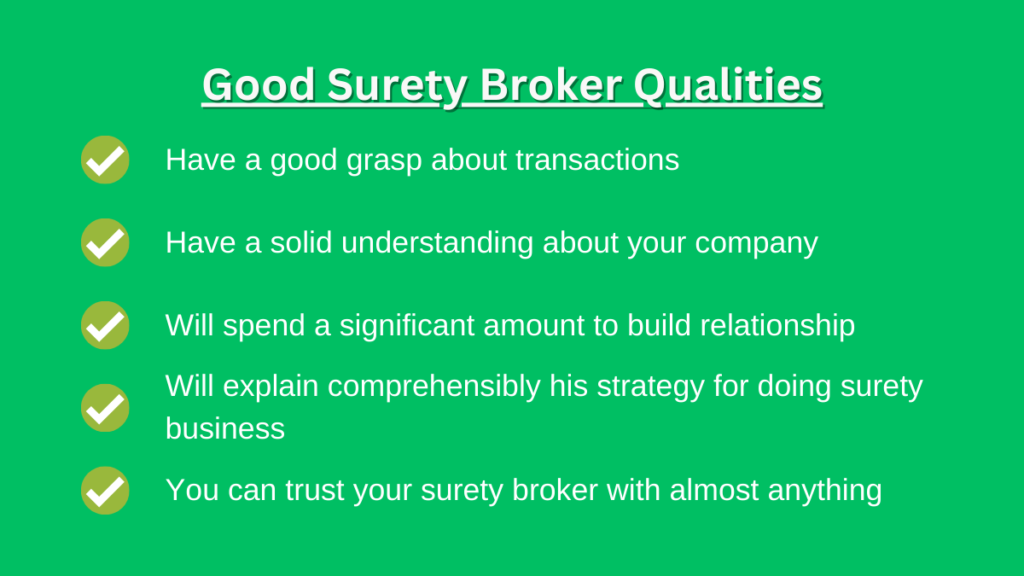

- When it comes to the surety market, a broker who has prior experience working as an underwriter for a significant assurance firm for a number of years will typically have a good grasp of how transactions are completed in this market.

- Your broker has to show that they have a solid understanding of both the financial and operational aspects of your company.

- Since this is what helps them pitch your offer when they make a phone call to an underwriter to test the market, a smart broker will spend a significant amount of time getting to know your firm. If you have a reputable broker who has the necessary relationships, it just takes one or two phone calls to rapidly pre-sell your company to a quality surety market, and the underwriting documents will follow shortly after that.

- An expert broker will explain the surety market in terms of where you fit into the market, whether it be a specialized secondary or substandard market, or a normal surety market. This will be done in terms of where you fit into the market.

- Make sure that you have a lengthy conversation with your broker and that you ask them questions about their company as well as how long they have been employed in this sector. A reliable broker will explain in great detail his strategy for doing surety business in a way that is comprehensible to the client. After that, you may evaluate different brokers according to how comfortable you are with their level of expertise and knowledge.

- Due to the fact that you will be disclosing some very personal information, you should get the impression that you are in extremely capable hands and that you can trust your surety broker with almost anything. Do not be scared to approach your insurance broker for a recommendation to a highly reputable surety broker. This is something you should not be frightened to do. In order to acquire the necessary level of knowledge, you could furthermore be required to work with a surety broker located outside of your immediate area.