Surety Bond vs Fidelity Bond

Surety bonds are supposed to accomplish one thing, which is to safeguard everyone who is engaged in a contract. Nevertheless, surety bonds come in a variety of forms, depending on the requirements of your company.

The client who hired you to do a work is protected by the majority of surety bonds. Others, such as fidelity bonds, safeguard both the consumer and your company at the same time. Swiftbonds is knowledgeable about the many forms of surety bonds and can guide you toward making a more educated choice on the most effective means of safeguarding both your company and its clientele.

The two most significant categories of corporate bonds are called surety bonds and fidelity bonds. In most cases, a fidelity bond will guarantee the individual, while a surety bond will guarantee the performance. As a result, a fidelity bond is personalized for the individual, while a surety bond is tailored to the requirements of the particular employer, and this type of bond can be broken up into a variety of flavors, from payment to performance, etc.

There is a distinction between fidelity bonds and surety bonds, with the former covering positions of trust and the latter covering contracts. In times past, both of these were known as company surety bonds. Nowadays, the term corporate surety bonds is more commonly used.

When it comes to fidelity bonds, the damage that is incurred impacts both your clients and your company. Thus, it is imperative that both parties be safeguarded. Although fidelity bonds have certain restrictions attached to them, having one may nevertheless provide company owners with a sense of security.

Surety bonds are a kind of insurance that may safeguard both your company and its clientele from financial loss in the event of dishonest business practices. If you buy a certain kind of bond, you could be protected against certain kinds of loss. Here are some of those sorts of loss:

- Theft and dishonesty on the part of employees

- Theft and swindling in general

- Theft of client information, illegal use of bank account information, and faked signatures on cheques are examples of fraudulent or unlawful instructions that may result in financial loss.

- A loss that occurred as a result of fabricated or fraudulent papers. These documents would have been utilized in good faith, but when the fabrication was detected, it resulted in a loss.

One kind of legal instrument that guarantees the fulfillment of a contract is known as a surety bond. In order to ensure performance, it is necessary for the individual who will be conducting the project to submit a certain sum of money to a bonding business.

As the owner of a company, you may have to shell out money to ensure the satisfaction of your customers. Instead, you might ask the independent contractors or subcontractors who work for you to pay for a guarantee that the job they are hired to perform will be done correctly.

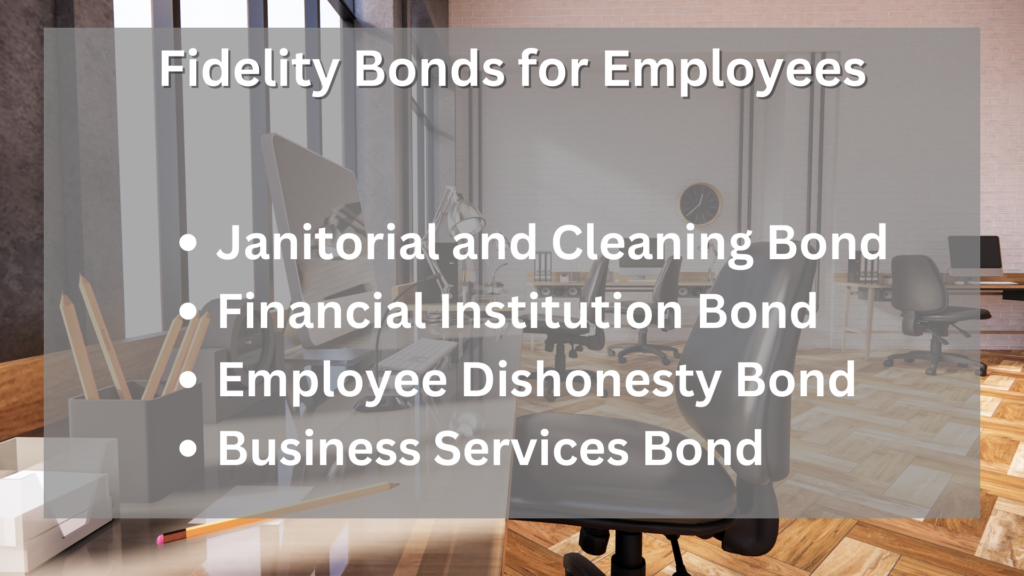

Fidelity Bonds for Employees

- Janitorial and Cleaning Bond – The customers of janitorial and cleaning services are the ones who are expressly protected by this sort of employee bonding.

- Financial Institution Bond – This form is used primarily for the purpose of bonding workers of financial organizations, such as banks and insurance firms. In addition to that, it offers security against dishonesty on the part of the employees.

- Employee Dishonesty Bond – This is a typical kind of employee bonding that protects companies against dishonest conduct committed by their own employees, such as stealing, embezzling, and forging documents.

- Business Services Bond – Your clients are protected against dishonest actions carried out by your staff, such as theft – thanks to this measure. When owners of businesses have obtained this bond, they often promote bonded staff in order to put the minds of their customers at rest.