Get An Instant Quote on Omaha, NE – Pawnbroker $5,000 Bond Now

Introduction

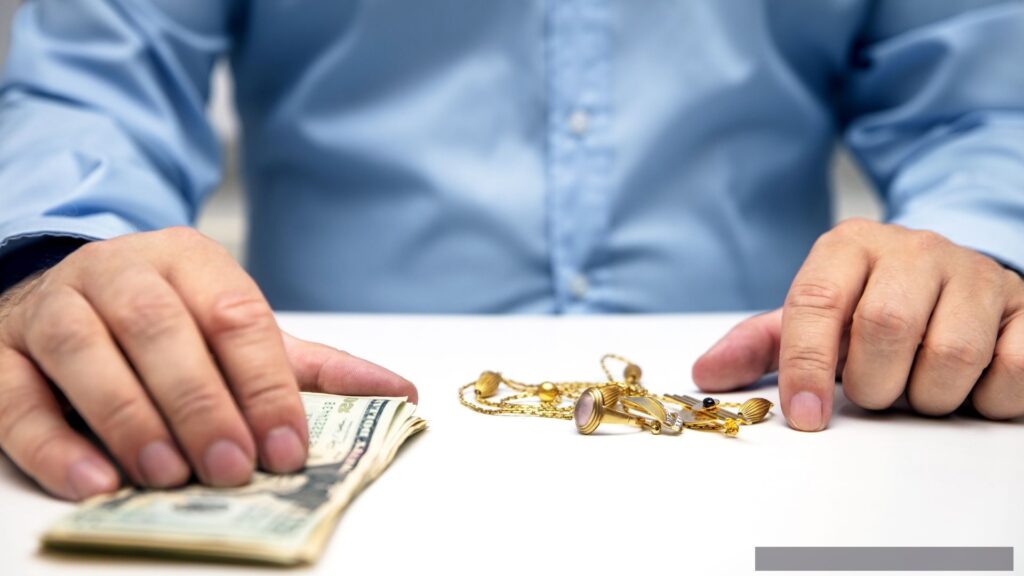

Pawnbrokers serve as a vital link between individuals in need of quick cash and those seeking a temporary financial solution. In Omaha, Nebraska, pawnbrokers are entrusted with this crucial role, but with trust comes responsibility. To ensure that pawnbrokers in Omaha conduct their operations with integrity and adhere to regulatory standards, the city mandates the Omaha, NE Pawnbroker $5,000 Bond. In this comprehensive guide, we will delve into the intricacies of this bond, its significance, requirements, and the critical role it plays in promoting trust within the pawnbroking industry.

Unveiling the Omaha, NE Pawnbroker Bond

The Omaha, NE Pawnbroker $5,000 Bond is a financial guarantee that pawnbrokers must obtain as part of their licensing requirements. This bond serves as a symbol of trust, assuring both the city and customers that pawnbrokers will conduct their operations with transparency, professionalism, and adherence to regulatory standards.

Understanding the Bond’s Purpose

The primary purpose of the Omaha, NE Pawnbroker $5,000 Bond is to protect the interests of customers and ensure the ethical conduct of pawnbrokers. Pawnbrokers play a pivotal role in providing financial assistance through collateral-based loans and selling secondhand goods. This bond acts as a safeguard, ensuring that customers have recourse in cases of financial disputes, fraud, or non-compliance with regulatory standards by pawnbrokers.

Who Needs the Bond?

The bond requirement applies to individuals or businesses seeking to operate as pawnbrokers within the city of Omaha. Whether they are independent pawnshops or part of larger networks, the bond ensures that pawnbrokers prioritize customer protection and financial transparency.

Bond Amount and Cost

The bond amount for pawnbrokers in Omaha is set at $5,000. The cost of the bond premium is influenced by the bond amount, the pawnbroker’s financial stability, and creditworthiness. Pawnbrokers can obtain this bond from authorized surety bond providers.

The Application Process

- Select a Bond Provider: Pawnbrokers should choose a reputable surety bond provider authorized to issue bonds in Omaha.

- Complete the Bond Application: Pawnbrokers fill out the bond application, providing information about their business and financial history.

- Underwriting Process: The bond provider evaluates the pawnbroker’s financial health, experience, and creditworthiness to determine the bond premium rate.

- Bond Issuance: Once approved, the bond provider issues the Omaha, NE Pawnbroker $5,000 Bond, which the pawnbroker must maintain as part of their compliance with city regulations.

Promoting Trust in Pawn Transactions

Obtaining the Omaha, NE Pawnbroker $5,000 Bond is not merely a regulatory requirement; it’s a commitment to fostering trust within the pawnbroking industry. Pawnbrokers play a crucial role in helping individuals during financial challenges, and the bond ensures that they do so with integrity and accountability.

Conclusion

The Omaha, NE Pawnbroker $5,000 Bond is a vital component of the regulatory framework designed to protect the interests of customers and maintain ethical conduct within the pawnbroking industry. By understanding its purpose, requirements, and application process, pawnbrokers can operate with confidence, knowing they are part of a system designed to promote fair and ethical practices in the pawn industry in Omaha. Compliance with bonding regulations is not just a legal obligation but a commitment to upholding trust and transparency in pawn transactions.]

Frequently Asked Questions

Can a pawnbroker in Omaha, NE use the Pawnbroker $5,000 Bond to cover multiple pawnshop locations, or is a separate bond required for each individual shop?

In Omaha, NE, each pawnshop location typically requires a separate Pawnbroker $5,000 Bond. While the bond covers the pawnbroker’s activities and operations, it is usually specific to a single licensed location. If a pawnbroker operates multiple pawnshops within the city, they should obtain a separate bond for each licensed location. This ensures that each location is individually compliant with city regulations and that customers at each shop are adequately protected.

Does the Omaha, NE Pawnbroker $5,000 Bond provide coverage for disputes or issues related to the sale of firearms or other regulated items within the pawnshop, or are there additional bonding or licensing requirements for handling such items?

The Omaha, NE Pawnbroker $5,000 Bond primarily focuses on the pawnbroker’s financial responsibility, ethical conduct, and compliance with city regulations related to pawn transactions. If a pawnshop intends to engage in the sale of firearms or other regulated items, additional licensing and bonding requirements may apply, depending on local, state, and federal regulations. Pawnbrokers should consult with relevant authorities and ensure they have the necessary licenses and bonds to deal with such items within their pawnshop.

In cases where a pawnshop in Omaha, NE operates online or conducts e-commerce transactions in addition to its physical store, does the Pawnbroker $5,000 Bond cover these online activities, or are there separate bonding requirements for online pawn operations?

The Pawnbroker $5,000 Bond typically covers the physical pawnshop location’s activities and transactions within the city of Omaha. If a pawnshop engages in online pawn operations or conducts e-commerce transactions, it may be subject to additional bonding or licensing requirements specific to online or remote pawn activities. Pawnshops with online operations should carefully review local and state regulations to determine whether separate bonding or licensing is necessary to cover their online activities and ensure compliance with all applicable laws.