How to calculate performance bond

The price of a performance bond is determined by a number of different elements, some of which include the following but are not exhaustive to the:

- Amount of the bond

- Credit history and/or the principal’s current financial situation

- Dimensions of the contract, as well as the location of the responsibility to fulfill the contract

- Fees that are obligatory or required to be paid, imposed by an agency or broker

- Rate that is being quoted by the surety company

- Work currently being done and the principal’s employment background in the past

The total value of the contract determines how much you will have to pay for the bond. It is difficult to offer an accurate cost for the performance bond without first going through the underwriting process. This is especially true if you do not have a lengthy record that can be used to explain the cost in addition to the value of the contract.

Other factors that need to be taken into account include the financial history and credit score of the contractor, as well as the financial history and credit score of the owner. If the contractor has a history of financial difficulties, the cost of the bond may increase (for example, from 3 percent to 4 or 5 percent).

The rates are subject to change based not just on the sort of work that is being performed but also on the perceived level of danger associated with that work.

It is possible for the cost of a performance bond to change depending on the kind of bond and the customer. Nevertheless, a reasonable rule of thumb is that it costs between one and three percent (1–3%) of the total value of the contract.

When it comes to riskier contracts, the cost of a performance bond might go up by 1.5 percent to 2 percent, but if your financial grade is excellent, the cost could go down even more. A significant amount of weight is given in the pricing of the bond to the principal’s level of financial stability as well as creditworthiness. The cost of the bond will increase (or decrease), depending on the value of the contract.

What aspects are protected by a performance bond?

The duty of the party that is bonded to fulfill the performance obligations stipulated in a contract is what is covered by a performance surety bond. The party that is adversely impacted by the performance’s failure to meet those conditions might make a claim for damages against the performance bond if the performance does not live up to those requirements.

For example, the performance could be late or go over its allotted budget. The surety that is responsible for issuing the bond promises that the claim will be paid to the obligee as long as the claim is legitimate and is founded on reality.

Notwithstanding this, the contractor is still responsible for completing the work. In the event that the principal is required to pay the surety to settle a claim, the principal is responsible for repaying the surety the entire amount, plus interest as well as any applicable costs.

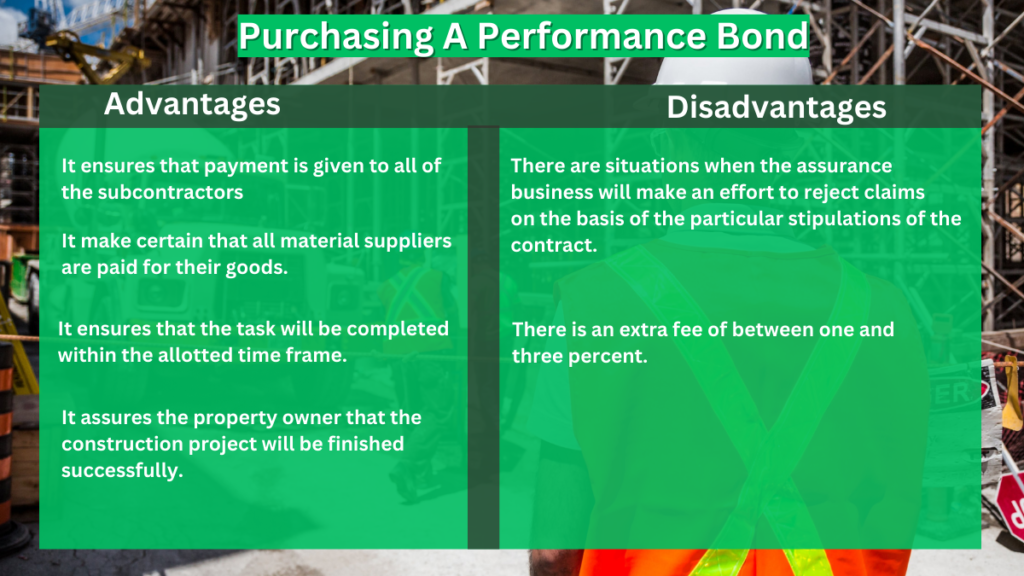

The advantages and disadvantages of purchasing a performance bond

Advantages

- They make sure that payment is given to all of the subcontractors.

- They make certain that all material suppliers are paid for their goods.

- They ensure that the task will be completed within the allotted time frame.

- They assure the property owner that the construction project will be finished successfully.

Disadvantages

- There are situations when the assurance business will make an effort to reject claims on the basis of the particular stipulations of the contract.

- There is an extra fee of between one and three percent.