Introduction: Planting Seeds of Assurance

In the vibrant financial garden of Arkansas, collection agencies play a critical role in ensuring debts are harvested fairly and legitimately. But how do we ensure these agencies do not exploit the fertile grounds of debtor’s resources? Here enters the Arkansas Collection Agency Bond, a tool ensuring that the activities of collection agencies remain ethical and within legal boundaries. Let’s embark on a journey to comprehend the nature and necessity of this bond in the lush landscapes of financial dealings.

Understanding the Collection Agency Bond

What is the Collection Agency Bond?

The bond acts as a financial guarantee, ensuring that collection agencies adhere to state laws and regulations, safeguarding both debtors and creditors from potential mismanagement or unethical practices.

Beneficial Bloom for Consumers:

The bond ensures that if the agency violates rules or engages in unlawful practices, consumers can make claims against the bond to retrieve due compensations.

The Roots of Necessity – Why the Bond is Crucial

Protecting the Soil:

Without proper regulations, the practices of collection agencies can potentially be harmful. The bond acts as a protective layer, ensuring that consumers are not unduly harmed by unethical collection activities.

Sustaining Healthy Growth:

It guarantees that agencies are operating within legal and ethical bounds, providing a safe and trustworthy environment for financial transactions.

Navigating the Financial Orchard – Acquiring the Bond

Application and Approval:

Agencies must submit a bond application, where their financial stability and integrity will be assessed. Approval would be contingent upon a satisfactory evaluation.

Bond Premium:

The agency is not required to deposit the full bond amount but rather pays a premium, which is calculated based on various factors, including financial health and regulatory history.

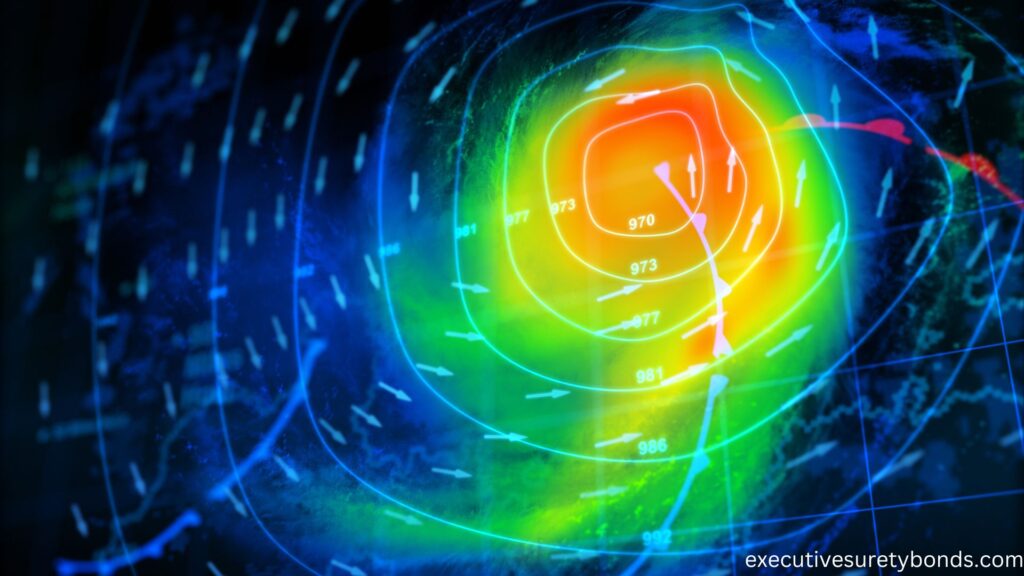

Weathering Financial Storms – Claims against the Bond

When The Sky Gets Cloudy:

If an agency errs, consumers can file a claim against the bond, seeking financial reparation for any losses incurred due to the agency’s misdeeds.

Claim Verification and Payout:

Upon receiving a claim, it is scrupulously investigated. If validated, a payout up to the bond limit can be granted to the claimant.

The Global Canopy – International Implications and Practices

International Weather Patterns:

Understanding and learning from global practices related to collection agency bonds can enhance and inform local practices, providing a more robust and comprehensive regulatory framework.

Adapting to Changes:

As international financial climates evolve, adapting practices and regulations relevant to collection agencies and their bonding requirements ensure continuous adequacy and relevance in protection mechanisms.

Conclusion: Reaping the Fruits of Ethical Practices

As we stroll back through the rows of our financial orchard, it’s clear that the Arkansas Collection Agency Bond is not merely a regulatory tool. It is a commitment to ethical practice, a shield for consumers, and a standard for the agencies, ensuring that the fruits reaped are justly and fairly attained.

Frequently Asked Questions

1. How Does the Arkansas Collection Agency Bond Deter Unethical Practices Among Agencies?

The Arkansas Collection Agency Bond acts as a form of assurance that collection agencies will operate within the legal and ethical guidelines stipulated by the state of Arkansas. When an agency is required to post a bond, they are making a financial pledge that they will adhere to lawful practices. If they fail to do so and a valid claim is made against them, the agency risks financial loss up to the full amount of the bond, which can be a substantial deterrent against engaging in unethical or illegal activities. Moreover, repeated claims or severe violations might tarnish the reputation of the agency, potentially making it more difficult and expensive to secure bonds in the future and could also lead to the revocation of their license to operate within the state.

2. What Happens if an Arkansas Collection Agency Chooses to Operate Without a Bond?

Operating without a required bond in Arkansas is a violation of state regulations and can lead to severe consequences for a collection agency. The absence of a valid bond signifies non-compliance with state laws, and the agency could be subject to hefty fines, legal action, and the possible revocation of their operating license. Not having a bond also exposes the agency to higher risks as it loses the layer of credibility and trust in the eyes of clients and customers, which could negatively impact business relationships and growth.

3. Can Technological Innovations Influence the Bond Requirements for Collection Agencies in Arkansas?

Yes, technological advancements can influence bond requirements, especially as the financial sector continually evolves. Technological innovations can introduce new methods of handling and collecting debts, which might necessitate adjustments in the regulatory frameworks to adequately protect consumers and regulate agency practices. Technologies that enhance data security, transparency, and efficiency might alter risk assessments and could potentially influence future bond amount determinations and requirements. Furthermore, advancements in digital platforms might streamline bond management, filing processes, and claims submissions, enhancing efficiency and accessibility in the management and utilization of the Arkansas Collection Agency Bond.